Elektroimportøren AS is a NOK750m mcap company listed on the Oslo Stock Exchange. Elektroimportøren is a full-range seller of electrical equipment through physical stores and online under the Elektroimportøren brand in Norway and Elbutik in Sweden. The company went public in 2021 on the back of operational momentum through COVID induced tailwinds. Following a couple of strong quarters, the share topped out at NOK88/share before the lights went out (no pun intended).

As I write this it has been 4 years since the share price peaked and the only thing that seemingly has increased since the highs in May 2021 is the number of shares outstanding. However, with 2 fairly good quarters in the rear view mirror, ELIMP now looks like an interesting way to get exposure to play a long-awaited pick-up in building and renovation activity in Norway (and partly Sweden), as Norwegian households gain confidence in lending rates dropping off at the end of the year (50 bps cut penciled in for 2H25).

About the company

Elektroimportøren AS is a specializes in wholesale and retail distribution of electrical installation products, lighting, heating solutions, and smart home technologies.

Established in 1994, the company has grown from a single store in Oslo to become Norway’s fourth-largest electrical wholesaler now operating 30 physical stores across Norway with 1 in Sweden. Elektroimportøren’s mission is to deliver high-quality products and exceptional customer experiences to both private consumers and professional installers both through physical stores as well as online. A less known fact is that they were an early e-commerce adopter. The company launched its own webshop as early as in 1996 (!).

The company’s business model is built on accessibility, innovation and customer focus in stores. Unlike traditional wholesalers, Elektroimportøren targets both private and professional markets, offering a their assortment of products through physical stores and online. Its product portfolio includes everything from basic electrical materials to advanced smart home solutions, with a particular emphasis on energy efficiency and sustainability.

The company’s own brand, Namron, is sold in all its stores. Not surprisingly, Namron has a superior margin structure than the remaining SKUs in Elektroimportøren, and is key for the company to maintain its gross margin versus competitors such as Onninen, Ahlsell and others.

Elektroimportøren also provide customers with access to a fully digital platform service called Spoton. SpotOn is a fully digital electrician service developed by Elektroimportøren AS, designed to make ordering and completing electrical work as simple and transparent as possible for both private customers and businesses. Customers can order an electrician directly from their computer or mobile device. By describing the job online, users receive a fixed price instantly, ensuring full cost transparency before any commitment is made. Once the job and price are confirmed, customers can choose a time that suits them for the electrician to visit. SpotOn is available in most major Norwegian cities.

In recent years, Elektroimportøren has expanded its footprint beyond Norway, notably entering the Swedish market through the acquisition of Elbutik AB. The first physical store in Sweden was opened in April 2023. More on Sweden and capital allocation later.

Management

Andreas Niss heads up Elektroimportøren as the CEO. He has served as CEO since August 2014 and obviously knows the company well. He has been overseeing the company’s transformation into a the omnichannel provider of electrical equipment in Norway (and Sweden) that it is today. Under his steering, Elektroimportøren has expanded its store footprint, scaled its online presence and become a listed company. He has been heading the development of the company’s current integrated B2B/B2C model, including the launch of the SpotOn platform and a strong private label offering (Namron). Prior to Elektroimportøren, Niss held management roles at Elkjøp (part of DSGI plc) including 5ys as Managing Director (2010–2014). He has also served as Marketing Manager for BP’s distributor network in Northern Europe.

Over to the CFO role, where the company over the past decade has had 2 main ones. Nils Petter Bjørnstad served as CFO from 2014 until April 30, 2023. He played a central role alongside Andreas in building up the company’s financial structure during a period of significant growth, including heading up the IPO process and Nordic expansion. Jørgen Wist succeeded Bjørnstad as CFO on May 1, 2023 and currently holds the company. Jørgen has however been with Elektroimportøren since 2014, starting as a category and purchasing director, and later as SVP for Namron (the company’s private label) from 2019 to 2023. Jørgen has made a solid impression and seems to be holding up the role well. The team as of lately been more hands on and vocal about managing prices, and have been able to defend the gross margin well over the last year or so.

Andreas holds of 635k (NOK7m) shares in the company, while Nils Petter owns 173k shares (NOK2m). Obviously not enough to care more about the long-term share price than their current salary, but sufficient to keep them incentivized.

Owners and board

Elektroimportøren AS was founded in 1994 by Per Norman Nielsen, who served as the company’s founder and initial owner. For the first two decades, Nielsen ran the business, overseeing its growth and development as a unique player targeting both professional and retail markets in Norway.

In early 2014, a significant change in ownership occurred when Herkules Capital, a Norwegian private equity fund, acquired a majority stake in Elektroimportøren AS and its private label subsidiary, Namron AS. Despite this transaction, Per Norman Nielsen retained a substantial minority shareholding and continued to an active role in the company, particularly in sourcing and product development. Following the Herkules acquisition, the company continued its growth trajectory through opening of new stores which later led to a listing on the Euronext Growth Oslo stock exchange.

Today’s cap table can be viewed below. Currently Aeternum Management AS, ODIN Forvaltning AS, Mustang Holding AS, the Varner family and Melesio Capital AS are among the largest shareholders. The current shareholder list is as follows:

I would describe the Board of Directors as solid. Karin Bing Orgland chairs the board. She has a career in the financial sector, most notably with her 25 years at DNB where she held various management positions. She is joined by a retail “heavy hitter” and a renowned industry name in Norway, i.e. Kjersti Hobøl. She is the CEO of Nille AS and Nille Holding AS. Kjersti is a renowned name in retail and has years of management and restructuring experience in the sector, including being CEO of Princess and KID ASA. Kari and Kjersti are joined by Eirik Rogstad, who has a more financial background as an analyst at Seatankers and having previously working at ABG Sundal Collier and Nordea. Another Nille affiliate appears on the. Arvid Tennefoss is currently the CIO and CDO at Nille. He has more than 15 years of experience in IT and from relevant management roles. The last board member is Anders Jakobsson. Anders brings a Swedish perspective to the board and holds operational experience from roles as CEO at Bäckström Anläggning, Fibo Group AB, Beijer Byggmaterial AB and Elektroskandia AB.

Although none of the board members are owner operators, they should be a solid sounding board for Andreas and Jørgen and they should also be able to challenge them. Although the suggestion of allocating options to the members caused a stir when it happened, I am fairly ok with them getting incentives to drive shareholder value (although I would undoubtedly prefer them buying shares in the open market). A few weeks ago it became clear that both Karin (400k), Kjersti (400k), Arvid (100k) and Anders (100k) subscribed for all their warrants with an exercise price of NOK10/sh.

Competitive advantage

Elektroimportøren’s business model is characterized by its end-to-end value chain presence, disruptive private label strategy, omnichannel retailing, and a growing focus on digital installation services and sustainable energy solutions.

Why do customers opt for Elektroimportøren vs. wholesale competitors? Well, a few things. Elektroimportøren offer market leading availability through their stores who have wider opening hours vs. wholesale competitors who normally close at 1600 hrs. Due to their network of stores, they have a warehouse close to customers at 3-4x the size of their competitors. Moreover, a somewhat overlooked element is the fact that Elektroimportøren stores also offer electricians a place to sit for lunch, meaning that they can combine shopping with eating which creates routine buying and store visits from B2B customers. From a B2C perspective, the primary differentiator is Elektroimportøren’s trained staff and breadth of assortment. It creates comfort when people without the appropriate expertise are guided by trained staff. It is also a nice way to sell Namron products at superior margins, and it is also more easy to guide customers to Namron products in store vs. online.

On the flip side, Elektroimportøren is not as good as their competition on next-day deliveries to B2B customers, which they have been explicit about. Moreover, they are also not the obvious option if customers are solely focused on prices.

Key mistakes and reasons for the share price decline

At the bottom of this section you can see EBIT, NI and the share price development in one chart. Obviously not the happiest of reads. I’ve jotted down my thoughts on the reasons for the share price decline below:

I’ll start with the most glaring mistake. The acquisition of Elbutik for cSEK235m. A deal that seemingly made strategic sense as the company’s first entry into Sweden, but turned out to be horrible. The acquisition was financed by a mix of cash on hand and debt, with a price negotiated based on all time high/peak numbers for Elbutik. The upped debt level turned out to be deadly. Following the transaction, the company increased liabilities to financial institutions to NOK375m from NOK205m, and when everything went south later on, Elektroimportøren had to issue shares at the worst possible time (at NOK7.5/sh) due to being close to in a breach of covenants, increasing the number of shares outstanding with close to 90% (!!).

It also turned out that the gross margins in Elbutik was unsustainable. One of the competitive advantages of Elbutik was how it sourced electrical components from whoever at the lowest cost possible. When Elektroimportøren took over they weren’t able to sustain that practice given their scale, established relationship with suppliers and requirements that came with it. The result was a degradation in gross margins and a much poorer operating outcome than I believe the company underwrote when they acquired them. Its almost like there were reversed synergies here.

The company stipulated the trends following the surge in demand for their products following C19. They weren’t the only one that interpreted the uptick as more permanent than it actually were, leading to the company tying up too much inventory and being too expansionary with regards to marketing and sales related costs at the peak. Operational leverage works both ways, and when the demand ebbed out margins disappeared.

The current one-store-setup in Sweden is subscale, the brand recognition among customers is lower and it turned out that it is difficult to nudge buyers to opt for Namron products when online. Not a disaster, but I do think Management thought it was easier to increase its share of own products than what turned out to be the case. Elektroimportøren has assessed options for its Sweden operations which included selling the store and shutting it down in its entirety, but opted to keep operating as-is (most likely due to cost of winding down, lack of interest from buyers and long-term lease commitments).

The company has a less-than-stellar track record with regards to product launches. They especially overestimated the demand for solar panels in 2022/2023 and spent too much on building up inventory in the category too early. They have been trying to turn out the inventory here to free up cash, but liquidity and margin severely suffered as a result. SpotOn also seems like a service that’s good for consumers, but I’m really not sure about how profitable/accretive the business area is. I know management spent some time on looking at opportunities to broaden the range of services offered on the platform (to e.g. plumbing services), but they weren’t able to attract external partners to join them. As such, SpotOn was re-integrated into Elektroimportøren again in late 2024. Seems like they’ve spent a fair amount of time on this, but hopefully not alot of costs…

During 2023 and at the start of 2024 the company willingly kept prices stable although cost prices increased in an attempt to stay competitive on price. It however turned out that the customer sensitivity to prices weren’t as high as initially assumed, which led to margins taking a somewhat unnecessary hit. I give Andreas and Nils Petter credit for turning around rather quickly here. Lately they have been much more willing to increase prices to defend gross margin, which is evident in last quarters’ numbers.

They invested heavily into logistics setup in Sweden too soon, which in hindsight turned out to be incorrectly sized (too big of a setup given the size of ops it was suppose to support). Capex and operational costs that were unnecessary.

Overall I truly understand why the share price collapsed, and although the company has faced a challenging market the last few years I believe a lot could have been avoided (although I must admit I liked the acquisition of Elbutik and the rationale behind it when it was made public - hindsight is 2020 I guess).

Financials

Onto some numbers. As usual I’ve posted my estimates below. Most important assumptions are as follows:

Top line growth of 10% in 2025E and 8% in 2026E. Store openings alone should support high single digit growth in 2025E so hopefully I’m not too optimistic here. LFL growth should also come out in the low single digit range.

Gross margin trend continue upwards during the next few years, reaching just north of 36% in 2026E vs. 37-40% between 2020-2023. With a continued weakening of the USD that might be too conservative, but competition is intense and ELIMP are still 5-8 pp. above industry averages.

Operating costs increases, but less than topline growth (approximately 85% of the increase). Currently growing 8% from 2024 levels in 2025, and then 6% in 2026.

Cash conversion (CFFO/EBITDA) at around 75% and capex at around 1.2% of sales. Difficult to draw trendlines from historic data as it fluctuates greatly.

I have assumed that net financials trend somewhat down from 1Q25 (inflated due to currency loss on hedges in the most recent quarter).

On debt, I’ve assumed that they remain well within current covenant boundaries. The covenant is tested quarterly and is set at 4.0x (for 1Q and 2Q25), 3.75x (3Q25) and 3.5x (4Q25) NIBD/NGAAP EBITDA on a rolling 12 months basis. It was at 1.5x in 4Q24 and 1.9x in 1Q25 which I believe is where it should peak (EBITDA should improve going fwd).

All-in-all this translates to an adj. EBIT margin moving from 3.6% in 2024 up towards 5.5% in 2026E, translating into an EPS of around 1.2 NOK/sh in 2026, which in my opinion should be the starting year you focus on if you’re looking at ELMIP today. It is also worth noting that Sweden contributes negatively to EBIT in 2025E, so it could very well turn out that the margin upside is larger than what I’m assuming. My estimates are c 10-12% below current consensus in 2026E (which I’m fine with tbh). Could certainly see upside on my #’s, however, that uncertainty also includes a downside.

Valuation

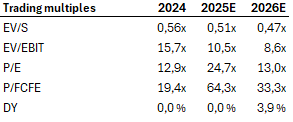

At NOK15/sh the company is trading at around 10.5x 2025E EV/EBIT, which shrinks to 8.5x in 2026E. I however do believe 2025 will be a turning point from a sentiment perspective. Going out of the year, I believe focus will gradually shift towards i) the Company’s ample room to open stores in Norway and Sweeden for years to come, ii) upside on a LFL basis on the back of a consumer sentiment uptick (falling rates in Norway coming in 2H), iii) tailwinds from an increase in broader construction initiatives (in Norway in particular) and iv) sustainable long-term margin upside, also supported by the Sweden operation turning an operating profit in 2026. With that as a backdrop, 8.5x EBIT and 12-13x PE looks too low and there’s probably a 20-30% upside on those multiples. Margins could also move higher than what I pencil in, and if so, that comes on top.

To conclude. Elektroimportøren has definitively been cheap for a reason, but with the last couple of quarters in the rear view mirror, an entry at around NOK14-15/sh looks attractive. There’s a 20-30% upside on multiples mid term, and for longer term investors there’s likely a longer term growth and margin recovery story to follow from here.

As always, let me know if I’ve missed anything or if you look at things differently than I do. I’m not a shareholder in the company at the moment (could change though).