BEWI ASA is a vertically integrated European provider of packaging, components, and insulation solutions. It is a NOK5bn MCAP company listed on the Oslo Stock Exchange. The company went public in late 2020 and as of now (Dec ’24), offers investors a highly levered way to play a rebound in the Nordic/European construction cycle. Even though the balance sheet is somewhat stretched, liquidity is sound and the underlying business is of high quality. The founding families still control the company, holding just >50% of the shares outstanding, and have no interest in issuing shares to de-lever the balance sheet around these levels. Risk/reward seems interesting, with D&A reported in the P&L likely ending around EUR65m in 2025 and 2026 against CAPEX estimates at around EUR23-30m.

Briefly about the company

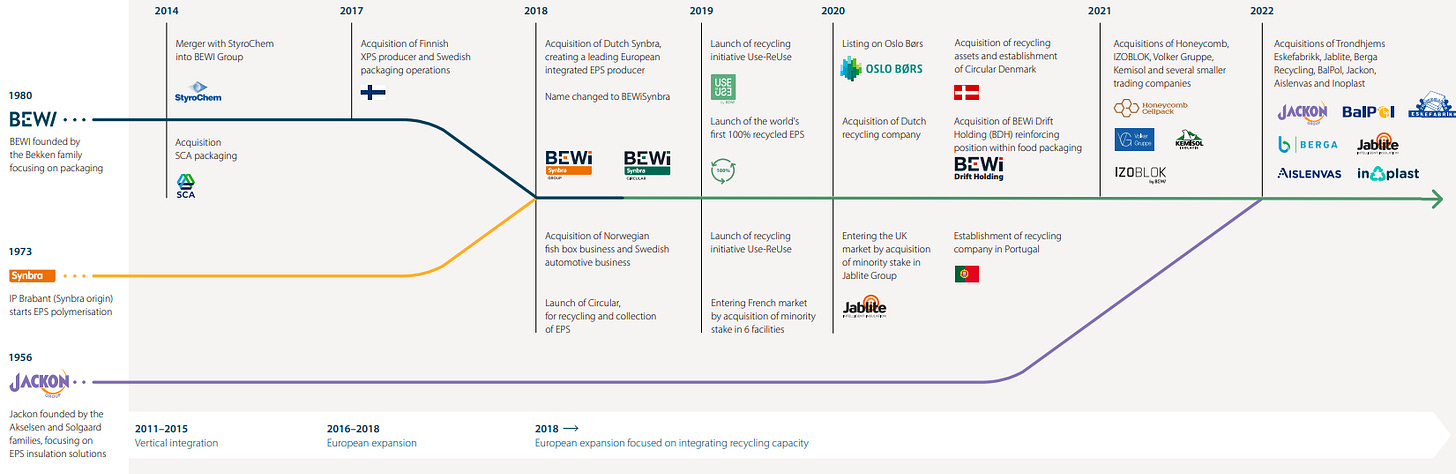

BEWI was founded in 1980 by the Bekken family. The company started out by supplying styrene boxes to the Norwegian fish farming industry (used to transport fish). BEWI later branched into insulation solutions. Today’s company is a result of a series of mergers and acquisitions and has an annual turnover of more than EUR1.1bm across 75 facilities in 14 countries. The various factories can be seen as local monopoly-like businesses, where its irrational for competitors to compete head-to-head with BEWI by building new competing factories in the areas that BEWI operates. Most key customers are already located fairly close to BEWIs facilities (especially in the P&C segment) and thus benefit from low transportation costs by not needing to move lightweight EPS over long distances.

Segments

BEWI operates across 3 operating segments which I’ll briefly outline below. The TL;DR on their value chain is visualized below for those of you less interested in reading.

Raw (upstream)

Segment RAW develops and produce a range of raw material products called expandable polystyrene (EPS), general purpose polystyrene (GPPS) and biofoam (BF). The segment uses styrene as an input to produce EPS/GPPS/BF, which later is sold upstream to produce end products such as building insulation boards. The EPS/GPPS/biofoam products are sold both externally and internally downstream to customers mainly in the building and construction markets (represents c70% of segment’s total sales). As styrene is a commodity, the segment is exposed to fluctuating styrene prices and they continously need to adjust prices to protect margins. As of 2023 segment Raw represented 27% of sales and 21% of the group’s EBITDA.

Insulation and construction (I&C) (downstream)

BEWI’s insulation and construction segment develops and manufactures insulation solutions for the building and construction industry. This segment represented 37% of group sales in 2023 and 36% of its EBITDA.

Packaging and components (P&C) (downstream)

The P&C segment makes customized packaging solutions and other technical components for its customers who are mainly in industrial sectors. In 2023 it represented 46% of the groups adjusted EBITDA and 32% of its net sales numbers.

Circular

Although small at 5% of sales and negative (3%) EBITDA margin contribution, BEWI’s circular segment has strategic value and allows the other downstream segments to sell more differentiated products. Circular is responsible for collecting and recycling EPS, as well as offering waste management, material trading and re-processing services to the BEWI group and other customers. The segment operates at a close to break even level, and I’ve not assumed any contribution here going forward. I do however believe that access to recycled EPS benefits the company in the P&C and I&C segment.

Below is a snapshot of the Company’s geographic footprint across its 3 segments.

Owners

BEWI ASA is majority owned by BEWI Invest AS who holds 51% of total shares outstanding. BEWI Invest is a Norwegian industrial holding company owning companies primarily within industrials, real estate and seafood sector founded by the Bekken family who owns 69% of the shares in BEWI. At number 2 with a 23.8% ownership in BEWI Invest comes Kastor Invest Holding AS, a company owned by the Thoresen family. ,

Number 2 on the cap table is HAAS AS owned by the Akselsen family. HAAS AS owned 50% of Jackon Holding AS, a company acquired by BEWI back in October of 2021 where HAAS AS decided to sell their share in Jackon agains shares in BEWI. They currently own 17% of the shares outstanding in BEWI ASA.

Number 3 on the captable is Kverva Industries AS at an 8% ownership stake. Kverva was established in 1991 as a holding company for the ownership in SalMar ASA – a publicly listed company that produces farmed salmon of the coast of Norway with a NOK72bn market cap, of which Kverva owns 45%.

All in all, BEWI is controlled by BEWI invest who likely has close ties and frequent dialogue with the other 2 large owners. Collectively these parties owns 76% of the company. That makes the free float low, which might be a negative from an index inclusion point of view, but positive given that the CEO and his family have a great deal of skin in the game and should be considered a very active owner.

Below is the company’s largest shareholders as of December 2024.

Management and board

BEWI ASA is headed up by Christian Bekken (b. 1982), who’s obviously a member of the Bekken family. Christian has been with the company since 2002 and have held various positions within BEWI. My impression is that both Christian and BEWI invest have a long-term mindset, and he’s without a doubt very familiar with the core business. As the CEO and majority owner however, I think that there’s a fine balance between balancing talk about long-termism and taking market share, with risk management and profitable growth on the other side. The company and CEO speak frequently about how they’ve grown the top line and their acquisitive past, however, it’s far from evident to me that historic acquisitions have created shareholder value on a per share basis to date. I understand that the company have been facing an extremely challenging market during the last couple of years, however, truly long term companies should be setup to handle such adverse environments. However, he strikes me as a hands-on CEO who’s been hands-on in the work with adjusting costs throughout the business during the downturn we’ve witnessed (still are) the last couple of years.

BEWI’s CFO is Marie Danielsson (b. 1975). She has been with the company since 2015 and has an audit background from KPMG as well as a background from being a VP with Haldex AB. Based on the answers given on conference calls and in other presentations, she seems to have a solid grasp on the numbers and a good understanding of the fundamentals.

The board is headed by Gunnar Syvertsen who is the CEO of Heidelberg Cement Northern Europe. Gunnar is closely tied to BEWI Invest for whom he also works as a consultant. Gunnar has chaired the board at BEWI ASA for 10 years and has operational experience. Not sure to the degree he is able to challenge the CEO though. Mr. Syvertsen is joined by Andreas Akselsen who represents HAAS AS on the board, as well as Pernille Skarstein Christensen who represents Kverva AS. All in all a board that’s controlled by the largest owners, even though there are independent members on the board as well.

M&A

BEWI has been an active consolidator of small and large competitors in the segments they operate in, having made 18 acquisitions since 2020 totaling approximately NOK660m in revenue at the time of acquisitions, which is 60% of the company’s estimated total revenue in 2024. Even though the acquisition of Jackon in 2021 almost doubled the company’s revenue, a typical acquisition adds 3-6% to the company’s top line.

BEWI is clear about the company’s acquisition strategy, where they look to buy small-to-mid size competitors in adjacent geographies or with a complimentary product portfolio in the segments they operate in. BEWI typically pays between 5-7x EV/EBITDA, which compares with BEWIs historic trading range of around 9-11x (currently around 7x CY financials). I would expect them to continue to add between 5-10% of inorganic sales growth per year once their balance sheet is shored up (likely some time 2H25, but who knows), although I have not penciled in any inorganic growth in my estimates below (have assumed delivering going forward).

BEWI has been acquiring companies actively for approximately 10 years now. I have limited insights into how good or bad the acquired companies have performed post completion, although I can understand how it makes sense to acquire companies with an established position instead of building greenfield facilities and compete head-to-head in the same geography.

The timeline below shows how the company from developed from a packaging producer in Norway in the 1980s to a vertically integrated producer across a broader range of products with a European footprint it is today.

Lastly I want to add a few words related their acquisition of Jackon - the largest acquisition the company has made to date. At that time Jackon and BEWI were the 2 largest integrated EPS producers in the market. Post acquisition, BEWI would become the number 1 player. The acquisition was announced in October 2021 and BEWI paid approximately 9.25x trailing EBITDA for the company. Judging by that multiple, they must have felt that there were significant strategic benefits from such an acquisition and they probably had identified substantial areas where they could realise synergies post acquisition (cEUR13.5m actually, c4% of the purchase price of EUR330m). What followed is - from my perspective - a key reason behind why the share is depressed currently. Due to the size of the investment, regulators spent a great deal of time assessing how the acquisition would impact competitive dynamics in the market. It ended with BEWI having to divest certain assets before the regulator approved the acquisition. However, the approval was given 1 year after the bid was announced, meaning that all post acquisition plans were significantly delayed. The timing could hardly be worse. During that time, inflation rose with interest rates following closely, resulting in the worst market conditions in the building and construction sector in Europe since the second world war. All segments struggled in the years that followed, including Jackon who probably suffered more than the other businesses in the group due to BEWIs lack of being able to implement cost cutting measures into a severe industry downturn.

Balance sheet and debt

What I believe worries most investors in the company is its level of debt. As of 3Q24 the company the company is way above its 2.5x NIBD/EBITDA (ex. IFRS 16) target. The company is currently hovering around the 4.3x level.

Here’s why I’m not too worried about that though:

i) 2H24 is probably as bad as it gets from an operational standpoint. Interest levels in the Nordics have topped out, they’re coming down in the EU and most indexes that indicate activity levels in the construction industry are trending higher on a YoY basis (yes, on easy comps, but still). Norway just recently reduced their equity requirement for home buyers, which all else equal is likely to push prices up as we enter 2025.

ii) Liquidity is sufficient and above EUR95m currently. Moreover, management has been explicit on shoring up additional cash to increase it further, pointing to an available liquidity target of EUR150m by the end of 2024. I don’t know exactly where they’ll end up, but management pointed to positive working capital effects and increasing volume expectations during their 3Q24 call. To put that number into context, releasing EUR55m in liquidity equates to a 8% FCFF yield in one quarter.

iii) The company has a sustainability linked EUR250m bond outstanding. It was issued in September 2024, matures in September of 2026 and has an early redemption provision in March 2025 on 50% of the outstanding at that date. It has no covenants tied to it and as such there’s no risk of any breach that would require them to raise additional equity capital. The company has some bank debt, and they recently announced a new receivable purchasing agreement of EUR75m.

iv) The Bekken family is considering taking BEWI Invest AS (BEWI’s largest owner) public. They bought SingkabergHansen AS in early 2023 and as part of that process did a private placement of NOK600m, where they also communicated the intent to list the company at a later stage. I very much believe that they will avoid having to invest additional capital in BEWI ASA or dilute their ownership in the company around the current share price with that backdrop.

Projections and valuation

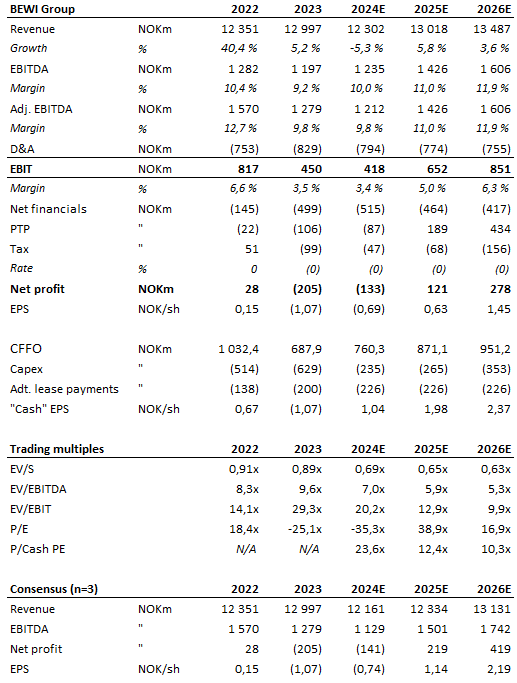

I’m assuming that fundamentals bottom in 2024. I’m penciling in organic growth returning in 2025 and that margins gradually return to approximately where they were in 2019 during the next couple of years. Some might see that as too optimistic, however I would remind you that the company has aggressively cut fixed costs the last couple of years – and considering the significant operational leverage in the business as volumes return – I believe margins in the medium turn actually could exceed what they’ve been historically.

On revenues, I’ve assumed that the company grows c6% next year. The company recently announced that it will merge its traded food packaging business with STOK Emballage, which accounted for cNOK75m of sales in 2024E. I’ve adjusted my revenue and EBITDA contribution (at c8% EBITDA margin) accordingly (any contribution going forward here will show up in the consolidated statement of changes in equity if I’m not mistaken). I’ve looked at the implicit organic growth rate vs. their 2019 numbers, which could be considered the last “normal” year for BEWI. My 2025E estimate implicitly assumes a 3.3% organic growth from their 2019 base, assuming 0% growth from their acquired revenue in the period from 2020-2024 (EUR660m acquired). I might be somewhat off on the growth in 2025E, but then again I believe my 3.6% topline growth estimate in 2026E is on the conservative side (which is also below consensus).

On margins, I’ve implicitly assumed that we move from around 3.5% in 2024E, through 5% in 2025E to around 6.3% in 2026E. Included in those are D&A numbers well above run-rate CAPEX, meaning that the underlying cash generation from the business should exceed what’s shown in the P&L even when subtracting leases.

What’s fair value? Looking at other industrial players with local moats, I believe I’d be willing to pay around 10x EV/EBIT assuming normalized margins – perhaps a bit more if fundamental business momentum is solid. BEWI themselves have been willing to pay 9-10x EBITDA for good assets pre synergies, so I don’t think I’m way off here. Private market multiples are likely at around 10x EBIT. Now, what do normalized EBIT margins look like? Probably around c7-8% (BEWI posted 8.4% in 2020 and 9.1% in 2021). However, BEWI probably won’t reach those levels until the back half of 2026.

To keep it simple, if the business can do EUR1.2bn (15% above my 2024E estimate) in revenues on normalized volumes and eke out a 7.5% EBIT margin, a 10x EV multiple implies c30% upside to the current EV. Removing NIBD as of 3Q24 (NIBD will likely come down quickly in the coming quarters, but nevertheless), I arrive at c55% upside on a per share basis or apr. cNOK35/sh. If we arrive there within the next couple of years, that’s a c20% return per year from here.

Below are my estimates, as well as consensus numbers the implicit multiples the company is trading at today (at around NOK24.5/sh). I’m somewhat above current consensus on 2025E, but below in 2026E.

Risks

The company went gung hoe straight into a downturn (Jackon was bought post covid), which would indicate a lack of end-market visibility, a somewhat imprudent risk management and a tilt towards an overly optimistic management? This could be a deadly cocktail when combined with aggressive inorganic growth initiatives. Moreover, they announced a NOK66m savings plan in the upstream segment in 3Q24. This far into the downturn? Seems late. However, the company’s focus on debt combined with ROCE partly offsets my concerns here. Will watch it carefully going forward.

Timing. I could definitively be too early here. I’ve been sitting on my hands for about 6 months before taking a position, and I very well should have been sitting on them for another 6 months.

Disclaimer: I own shares in the company. Not a large position though.