Introduction

AcadeMedia AB is Swedish provider of educational services listed on the Nasdaq Stockholm stock exchange with a SEK8bn mcap. The company was established in 1996 although the company has roots dating back to 1898. The share is currently valued at a single digit 1y fwd PE multiple due to its geographical exposure and political risks. However, the company continues to grow geographically – both organically and through M&A – while margins have room to increase. And as we know, with margin expansion and increased diversification, multiple expansion often follows.

About the business

AcadeMedia is northern Europe's largest private provider of education services, with operations spanning Sweden, Norway, Germany, the Netherlands, Great Britain, and Finland.

The company's business concept and model are centered around providing high-quality educational services. AcademMedia focuses on developing and managing educational institutions under distinct brands across the entire educational ladder. Their goal is to offer attractive educational programs across preschools, compulsory schools, upper secondary schools and adult education. You can see how the segments distribution has developed since late 2021 here:

With regards to its geographical footprint, Sweden is AcadeMedia’s by far largest geographical market with an annual turnover of SEK12.7bn (75%). Norway follows as the company’s 2nd largest market at 15% (SEK2.5bn) with Germany on 3rd with SEK1.6bn (c10%). Germany is however the geography the company expects to grow the fastest going forward.

How does the company operate? Well the company’s business model is built on a decentralized structure with key principles that flow through all of the company’s 4 segments. These are as follows:

Local leadership: Each principal or equivalent has overall responsibility for their respective units.

Hierarchical oversight: School superintendents or equivalent positions oversee multiple unit heads, ensuring consistent quality and performance across the organizations.

Quality focus: AcadeMedia has developed a market-leading quality model to measure and benchmark units across all relevant quality aspects.

Digital integration: AcadeMedia has implemented digital platforms like Campus Online to streamline resource management and improve accessibility for students and teachers.

The principles are in place to ensure consistency in quality across the group while also trying to allocate responsibility downwards.

The prominent risk from a licence to operate perspective is obviously shift in political sentiment, which is one of the reasons the company wont trade at a high multiple anytime soon (and rightfully so). I won’t opine on whether or not this is correct, but i) I believe the current political climate is more likely to tilt in favor of private participation going forward and ii) with increased geographical diversification the discount should be reduced (although I do believe it is fair to discount a certain amount of downside as a result of it). However, I’m no expert on day-to-day shifts in political sentiment towards private actors, so any insights from readers here would be warmly welcomed!

The company's strategy of international expansion is evident in the growing proportion of revenue coming from markets outside Sweden, with opportunities for further growth, especially in countries like Germany where demand for preschools remains strong. AcadeMedia's international operations (including Norway, Finland, Germany, the Netherlands, Poland, and small operations in the UK) now account for approximately 31% of the company's total sales, up from 24% last year. This increase is partly due to the acquisition of Touhula in Finland and continued expansion in other international markets, particularly Germany, where the company has been vocal about further expansion opportunities.

Financials

The company has historically grown its top line through a combination of organic and inorganic initiatives. Organic growth has since 2017 been between 4.5-8.1%, including what the company considers smaller bolt on acquisitions. On top of that, the company has added an additional 2% from larger acquisitions. The top line CAGR between 2019-2023 was 8.7%. Below is an overview of the company’s top line and margin development since 2014 (from their latest annual report).

I believe the company can continue to open new preschools and schools across its various segments. Expansion has been particularly successful in Germany, where high demand for preschool places allows for quick establishment and break-even within a year. In Germany, the company plans to open 10-15 new preschool units per year and on March 14th, 2025, the company announced that it will further ramp up its growth ambitions in Germany. Moreover, the company also stated that they are intensifying their efforts towards other geographies. The company has been communicated that international and adult education lines should move from c40% toward 50% as an ambition, clarifying how the company intends to expand going forward. Although it didn’t lead to material estimate revision, the clarity is welcomed.

Segment wise, the Adult Education Segment has shown strongest growth potential with higher volumes and improved capacity utilization driving profit and margin growth compared to the preschool and school segments. Related to organic growth, increased student enrollment will also help. Across various segments, AcadeMedia has seen a steadily growth in student numbers. For example, in 2Q24/25, the Preschool and International segment saw a 29.4% increase in enrolment. Moreover, continued development of proprietary online platforms has improved quality and efficiency in more operations, particularly in adult education, will help support the topline going forward.

When it comes to inorganic growth, the decentralized model facilitates profitable growth where newly acquired units are given clearly-defined roles and integrated into an established structure to ensure consistency in performance.

Below is an outline of the different business segments’ profitability development over the last quarters. As you can see, the Adult Education segment is the most profitable offering and the main reason for the positive EBIT trajectory the last 4 quarters. It was also however the main reason behind the decline that happened in 2022/23.

Capital allocation

Below is a snapshot of the company’s financial targets as presented during their recent 2Q report.

It is quite evident that their capital structure is currently way more conservative than what their 3.0x target allows for. Historically the company has paid out a modest c25-40% of their EPS as dividends, primarily because they’ve been explicit (probably also due their awareness of public perception) about re-investing in operations to maintain a high quality of service to its students. Note however that the company has also been willing to buy back shares as part of returning capital to shareholders. In feb/mar 2025 shareholders were given the opportunity to sell c3% of their holdings to the company at a price 25% above its current share price. The process returned another SEK300m to shareholders (who didn’t sell) via buy-backs. If you add that to the NOK178m in dividends, the total amount of capital returned to shareholders in 2023/24 landed at NOK475m, equating to a total shareholder yield of around 6% at the current share price level.

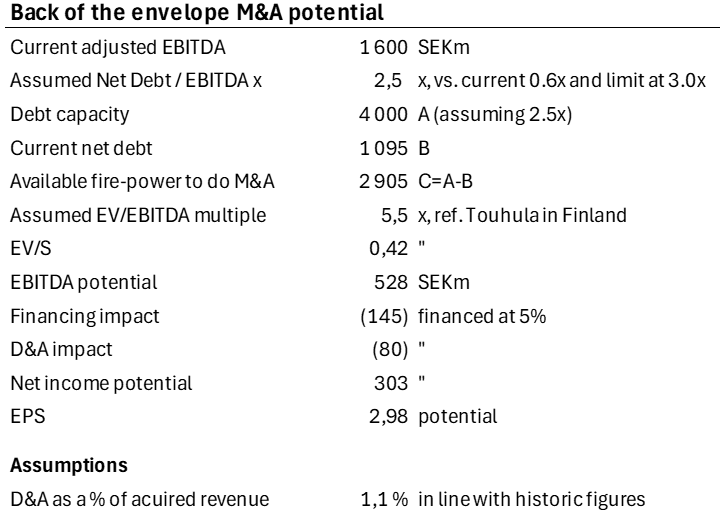

Given the political sensitivity of dividends and their current exposure to Sweden from a geographical perspective, I believe it is fair to assume that most excess capital will be used to do bolt-on acquisitions, which likely will combined with a modestly growing dividend and regular reversed tender offers. Assuming that they’re willing to really lever up to around 2.5x EBITDA, the company has cSEK3000m of available fire power to do M&A. Assuming the company goes on a shopping spree to get to 2.5x net debt/EBITDA immediately, I believe they can add approximately SEK3/sh. My assumptions on how I got here are outlined below. It is however unlikely that they’ll get there quickly considering how they’ve spent cSEK300m/y on M&A the last handful of years.

Management, board and owners

Marcus Strömberg is the CEO of AcadeMedia AB. He was born in 1967 and has been in his current role since 2005, meaning that he’s been instrumental in developing AcadeMedia AB as Mr. Strömberg has been with the company for over 20 years and holds 157k shares in the company. He’s in other words highly incentiviced to continue to create shareholder value and has a track-record that creates comfort.

The company’s CFO is Petter Sylvan. He was born in 1974 and joined the company more recently (March 2024). Sylvan has a master's degree in Automation Technology from Chalmers University of Technology. Prior to joining AcadeMedia, he served as the CFO at Profoto for 15 years, where he among other things led the company through its stock exchange listing in 2021. Petter owns c9k shares in the company.

The largest shareholder of AcadeMedia AB is the Andersson family via Mellby Gård. They own 24.4% of the company. Number 2 is Cobas Asset Management with 9.6% and DWS Investments with 4.7% of the shares outstanding. They are heavily represented on the board, as one would expect. Mikael Helmerson, the CEO of Mellby Gård AB, sits on the board, as do Johan Andersson who is chairman of the board of Mellby Gård and son of Rune Andersson. Håkan Sörman heads up the Board as the chairman. He has held that position since 2022, but he has been on the board since 2017.

Other members include Jan Bernhardsson, Ann-Marie Begler, Hilde Britt Mellbye and Marie Osberg as independent directors. In addition, the board consists of 3 employee representatives.

As you can see by looking at the captable below, Mellby Gård AB owns what in essence is a controlling stake in the company (other owners are way smaller and scattered).

Many people/shareholders therefore probably raised their eyebrows in February 2024 when Mellby Gård announced that they had sold their stake in the company to the Akelius Foundation for SEK65/sh (c25% premium to last close). Shortly following the announcement however, the intended buyer, Roger Akelius, announced his intention to carry out a paradigm shift at AcadeMedia via various media outlets. He stated that their plan “didn’t include any return assumptions” and that they considered the investment a donation rather than a financial one. The turmoil that followed resulting in the parties cancelling the transaction. However, it is now rather clear that Mellby Gård is a pragmatic owner who would be willing to sell their stake in the company to a third party at the right price.

I think it is positive that management has to report frequently to Mellby Gård as an actively engaged large owner. Apart from that I have no strong takes on the captable.

Estimates and valuation

As I’ve illuded to earlier, I haven’t assumed any major shifts in the years to come. My estimates are below, alongside current consensus numbers.

I’ve faded the growth rate, moving it from the 12.9% (which includes inorganic growth) we witnessed last year down to apr. 5.5% in 24/25E. There’s obviously upside to my topline assumption if the company continues to do acquisitions, which is quite likely given how they’ve spent SEK300m on M&A the last 4 years. If they acquire companies at a 2.4x revenue multiple for SEK300m it will boost my current top line estimate with c4%.

I have further assumed that the 1H24/25 trend continues and that we end up just north of 9% in 24/25E vs. 8.9% last year. Note that they adjust their EBIT margin by adding back lease costs recognized in their P&L as per IFRS 16 rules, then they subtract rent costs as was applied in previous periods. This basically reduces reported EBIT margins by 220 to 250 bps versus, implying that the company’s EBIT target on an unadjusted basis is 9.2-10.5% which leaves about 100-150 bps in upside vs. my estimates going forward before the company would be at their margin target.

To sum things up, I basically like that the company is reasonably valued, pays a healthy dividend (3% direct + 3% via reversed tenders) and I like it has ample room to grow through M&A. It is always difficult to evaluate how a company like ACAD given the political risk associated with a setup. However, the company has been able to grow its earnings steadily through the last handful of years, margins are consistently above 6% and rising, and the business model is relatively protected from business cycle fluctuations (you might argue that its counter-cyclical as adult education will likely benefit from higher unemployment).

All-in-all I’m willing to see around 12x earning as fair, which on my 1y fwd EPS estimate leads to around SEK110/sh in fair value. My SEK9/sh in EPS depends on margins continuing to move towards the company’s target, which might not materialize, but I do believe that I’m conservative when I’m “only” penicilling in a 5% growth going forward. Additional upside comes from inorganic growth and/or additional capital returns to shareholders if the company ups leverage towards it 2.5x NIBD/EBITDA target.

Risks

The most significant risk to AcadeMedia is obviously changes in legislation and shifts in the political landscape and public opinion towards for-profit education provider. The company's business model is heavily dependent on national education policies and regulations and any changes in these policies could significantly impact the company’s operations and profitability. This is by far the larges external risk factor investors should be aware of. Other risks include competition as AcadeMedia aims to expand internationally, particularly in Germany. Moreover, growing concerns about the negative impacts of Sweden's market-based school system, including increased segregation and inequality offer downside, as well as criticism of for-profit education providers and their impact on educational quality. Operations wise, a lack of qualified teachers across the education system could impact AcadeMedia's ability to maintain operational quality going forward.

Disclaimer: I own shares in the company.

Hello there,

Huge Respect for your work!

New here. No huge reader base Yet.

But the work has waited long to be spoken.

Its truths have roots older than this platform.

My Sub-stack Purpose

To seed, build, and nurture timeless, intangible human capitals — such as resilience, trust, truth, evolution, fulfilment, quality, peace, patience, discipline, relationships and conviction — in order to elevate human judgment, deepen relationships, and restore sacred trusteeship and stewardship of long-term firm value across generations.

A refreshing take on our business world and capitalism.

A reflection on why today’s capital architectures—PE, VC, Hedge funds, SPAC, Alt funds, Rollups—mostly fail to build and nuture what time can trust.

“Built to Be Left.”

A quiet anatomy of extraction, abandonment, and the collapse of stewardship.

"Principal-Agent Risk is not a flaw in the system.

It is the system’s operating principle”

Experience first. Return if it speaks to you.

- The Silent Treasury

https://tinyurl.com/48m97w5e

Very good analysis. Thanks, i have the notion of this company. Very good research , i will follow you and susribe. I´m analyst too and i think, that in my spanish channel you can find very good researchs -